概要

3 years experience as an accountant with in depth knowledge of accounting tools, procedures and transactions. Seeking to work in a challenging environment and grow with the company to achieve its goal and get additional knowledge.

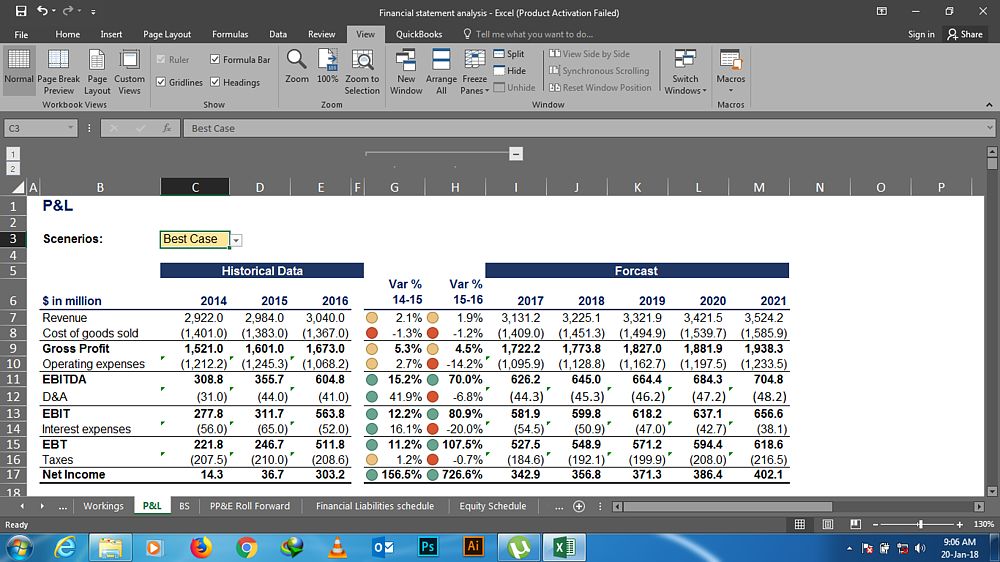

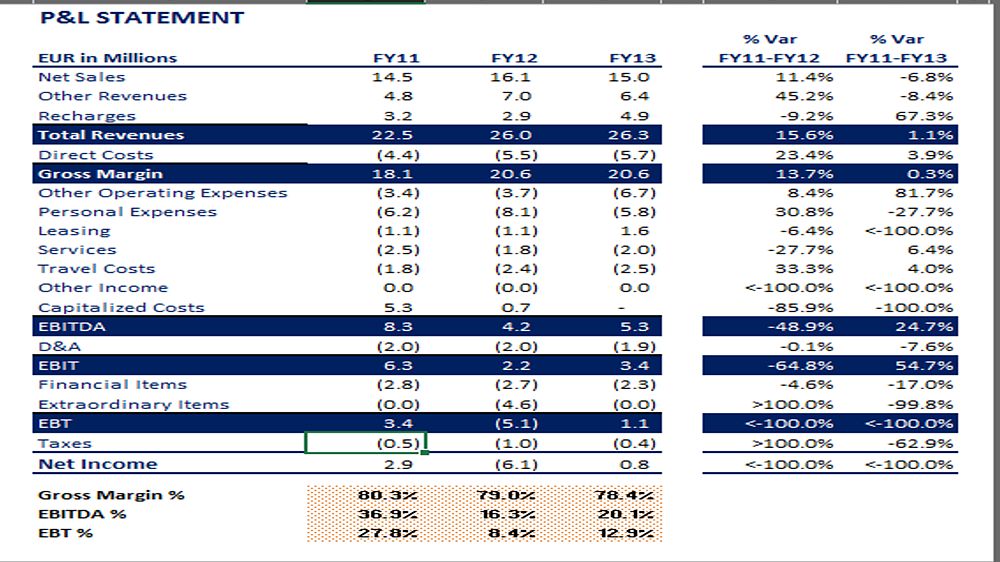

项目

工作经历

SMARTAX SOLUTIONS

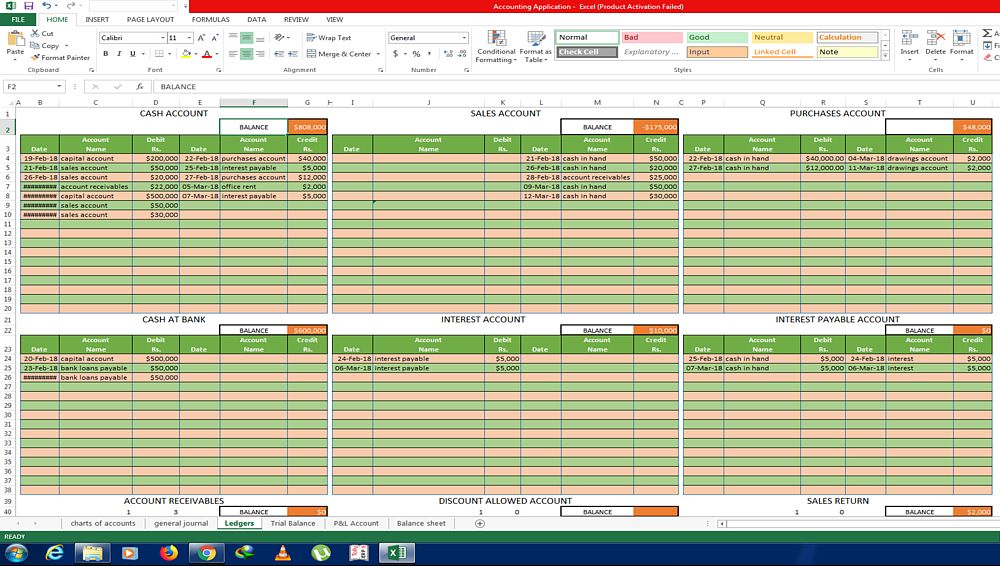

• Develops System to account for financial transactions by establishing a chart of accounts, Defining bookkeeping policies and procedures.

• Maintains subsidiary accounts by verifying, allocating and posting transactions.

• Balances subsidiary accounts by reconciling entries.

• Maintains general ledger by transferring subsidiary account summaries.

• Balances general ledger by preparing trial balance; reconciling entries.

• Maintains historical records by filing documents.

• Managing payroll on Monthly Basis

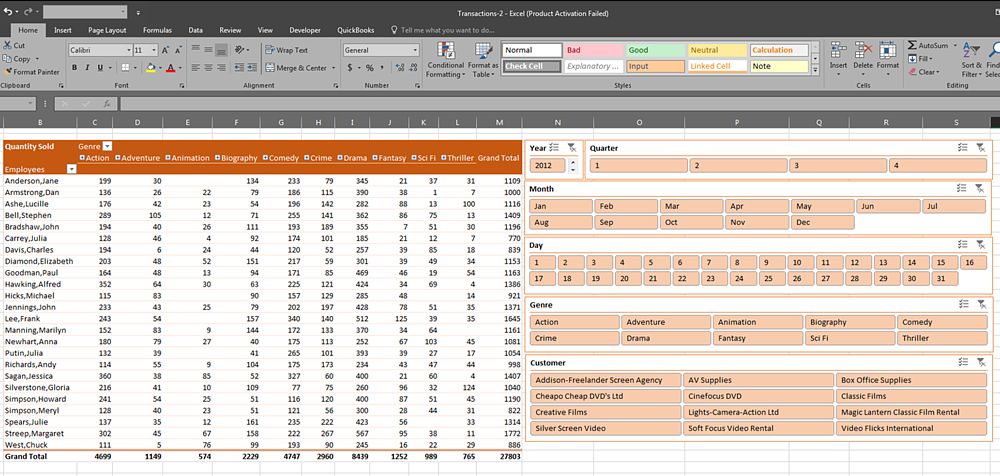

• Preparing financial reports by collecting, analyzing, and summarizing account information and trends.

• Filing Sales Tax On monthly basis

• Maintaining payroll records and Filing Payroll Taxes(TWC)

Intership

• Well conversant with account opening,Cheque book issuance,ATM card other operations,Updated knowledge on product and compliance.

• Clearing handling,remittance and payorder issuance or cancellation timely.

• Customer complain handling and guide them in a effective way.

Account Officer

Main Responsibilities at Vogue Tailors & Drapers includes the following activities:

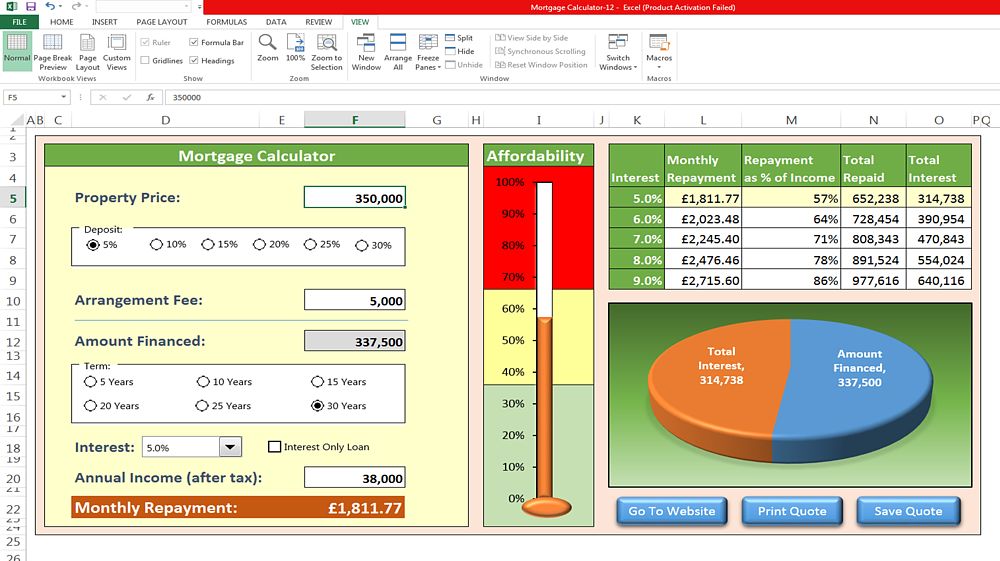

• Prepares asset, liability, and capital account entries by compiling and analyzing account information.

• Documents financial transactions by entering account information.

• Recommends financial actions by analyzing accounting options.

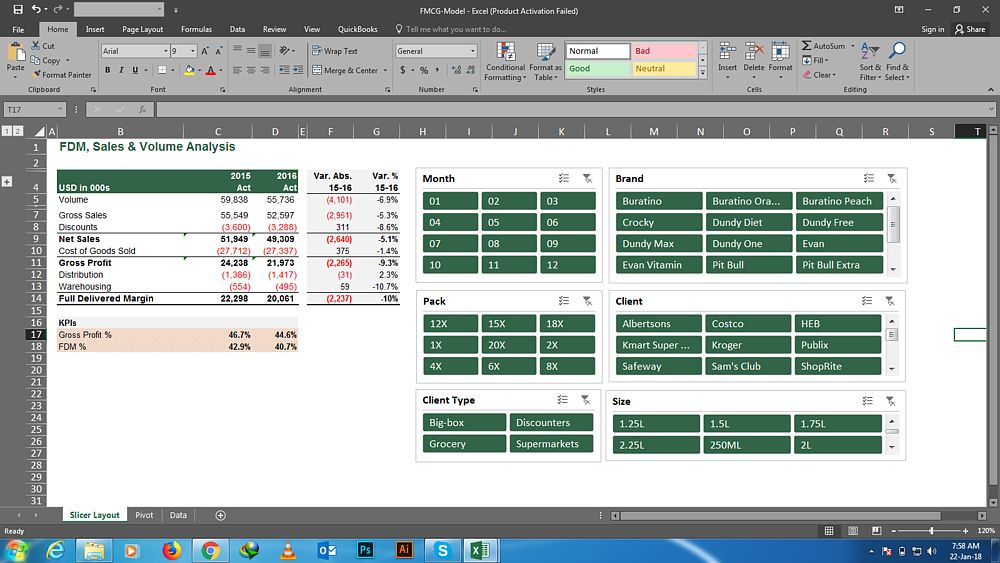

• Summarizes current financial status by collecting information; preparing balance sheet, profit and loss statement, and other reports.

• Substantiates financial transactions by auditing documents.

• Maintains accounting controls by preparing and recommending policies and procedures.

• Guides accounting clerical staff by coordinating activities and answering questions.

• Reconciles financial discrepancies by collecting and analyzing account information.

• Secures financial information by completing data base backups.

• Maintains financial security by following internal controls.

• Prepares payments by verifying documentation, and requesting disbursements.

• Answers accounting procedure questions by researching and interpreting accounting policy and regulations.

• Complies with federal, state, and local financial legal requirements by studying existing and new legislation, enforcing adherence to requirements, and advising management on needed actions.

• Prepares special financial reports by collecting, analyzing, and summarizing account information and trends.

• Maintains customer confidence and protects operations by keeping financial information confidential.

• Maintains professional and technical knowledge by attending educational workshops; reviewing professional publications; establishing personal networks; participating in professional societies.

• Accomplishes the result by performing the duty.

• Contributes to team effort by accomplishing related results as needed.

Cashier

• Achieved sales goals through product recommendation to guests.

• Assisted with the flow of guests by taking food and drink orders as needed.

• Cash handling and end of day revenue reconcilation and applicable paperwork.